Living Trusts

How Living Trusts Work

What is a Trust?

Trusts date back to the English Statute of Uses, which King Henry VIII passed in 1536 to permit bequeathing land to descendants by various written documents while protecting royal revenues.

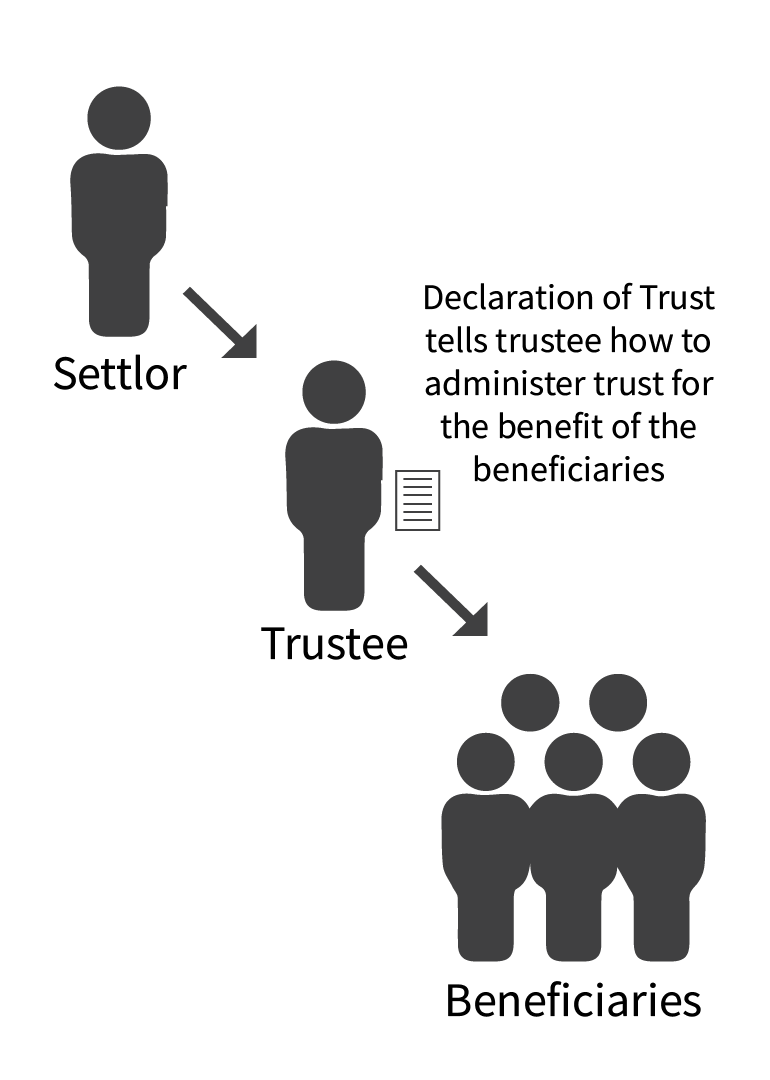

Since that time, the basic structure of the trust has evolved into one where one person (the "settlor") transfers ownership of assets (e.g. houses, bank accounts, stock) to another person (the "trustee") to be held for the benefit of either the person or persons for whose benefit the trust was established (the "beneficiaries").

The traditional trust paradigm

Living Trusts Today

In the standard modern living trust format, the settlor is generally also the initial trustee and beneficiary as well. Thus a single person will appoint himself as trustee of a living (i.e. amendable) trust for his or her own benefit for life, and a married couple will act as trustees of a trust for their lifetime benefit. The settlor/settlors will also transfer ownership of all his/her/their assets to the trust.

Benefits of a Living Trust

The settlor/settlors (as trustees) retain absolute control over their assets during their lives.

The settlor/settlors have the right to change the terms of the trust whenever they like.

Since the trust, unlike an individual, does not die, upon the death of a settlor there is no need for probate (court proceeding to administer the property of a decedent)!

Since there is no probate, there is no one-year-or-more court delay in getting the settlor's assets distributed to family or loved ones.

There are also no probate legal fees, which range from $4,000 on a $100,000 estate to around $25,000 on a million dollar estate.

Trusts are private unlike probate records, which are public.

If a settlor becomes disabled, the trust provides for a replacement trustee, so the expense and delay of appointing a conservator is avoided.

Trusts can also have estate tax (i.e. the Federal tax on what you own when you die) benefits for married couples, if the deceased spouse's estate is larger than the current amount that passes tax-free to a surviving spouse. In such a case, the use of an EPC "QTIP/CREDIT-SHELTER" Comprehensive Plan can save hundreds of thousands of dollars in taxes on the death of the survivor.